Some Of Debt Consolidation Scarborough

Table of ContentsMortgage Broker Scarborough Things To Know Before You BuySome Known Facts About Mortgage Broker Near Me.Fascination About Debt Consolidation ScarboroughAll about Jermaine Hinds Mortgage Broker

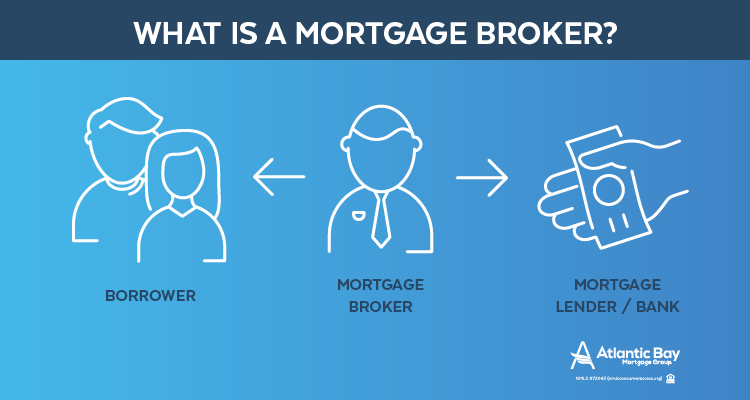

Discovering the right home mortgage broker is a vital step for lots of purchasers who want to acquire a house without working straight with a financial institution or lender. What does it take to end up being a home loan broker?

As a broker, you'll spend considerable time assessing a client's debt history and also earnings statements even more reason to have actually the skills stated in the section over. You wish to be sure your client can manage to pay off a mortgage without living income to paycheck. Home loan brokers vs. funding officers So, you've chosen you wish to operate in the home loan market.

Not known Incorrect Statements About Scarborough Mortgage Broker

Basically, you search to find the most effective bargain for your clients. Intrigued in coming to be a mortgage consultant? American Financing is working with! Take a look at our occupations web page to use for open positions. Home mortgage broker wage Since June 10, 2019, the average annual spend for a home mortgage broker in the USA is $74,399 a year.

The NMLS licensing charge for a home mortgage broker in many states is $1,500.

This training must be finished no more than 3 years before your application submission. When training is total, you must pass a two-part SAFE Home mortgage Loan Mastermind examination. You need to address at the very least 75% of the concerns correctly to pass the exams. Home loan broker bonding Mortgage broker bonds safeguard borrowers from incongruities taken by home loan brokers, as well as they ensure that mortgage brokers abide by state regulations.

With numerous lenders selecting to take care of home mortgages on their own, it's becoming even more of an obstacle to earn organization rapidly. Yet, the property market is still durable, so the ideal prospects can definitely produce their very own chances and make a truthful living.

Our Jermaine Hinds Ideas

You do not have to invest time researching and also comparing mortgage prices, terms, as well as costs due to the fact that they will. Home loan brokers must efficiently finish a provincially-regulated Home mortgage Broker training course as well as test.

Home customers now need to certify at the better administrative assistant for mortgage company job description of the Financial institution of Canada's five-year standard price, or your agreement mortgage rate plus two percent. This creates a barrier between the rate you're being offered and also the prices you could be paying in the future. claims that, for some buyers, the tension examination has led to brand-new questions.

The genuine estate market you can try this out has actually remained in flux for the last several years for numerous factors, but it has remained an area of chance for experts interested in helping others browse the purchase of a residence. With solid economic growth in the real estate and borrowing market incorporated with a renewed interest in own a home, certain professions in real estate deal encouraging occupation as well as company possession courses.

Things about Mortgage Broker Scarborough

Step 2: Pass the National Mortgage Permit System (NMLS) examination After completing your pre-licensure program, you will require to sit for as well as pass the National Mortgage Certificate System (NMLS) examination. Scarborough Mortgage Broker. The examination, referred to as the SAFE Mortgage Originator Test, challenges your understanding of the program product, consisting of broad home mortgage techniques along with state-specific standards and also guidelines.

You can collect even more details regarding signing up in NMLS, scheduling your test, as well as testing locations through the NMLS site. Step 3: Register as well as establish your home mortgage broker agent Once you have actually passed your exam as well as completed all the required coursework to do so, you prepare to register your mortgage brokerage firm organization.

Some states require you to have a physical place to obtain certified and also operate legally. When selecting any physical place, analyze the simplicity of accessibility for your clients, price of leasing area, as well as your he said readily available hrs. If you have the alternative to work with an on-line broker agent, plan for a house workplace area that permits you to successfully work.